After four consecutive years of a 0.1799 property tax rate (per $100 valuation), Shenandoah city council voted on August 10 to reverse course and use Montgomery County’s reported No New Revenue rate of .1477 for 2022-23. The formal vote is slated for the August 24, 2022 council meeting.

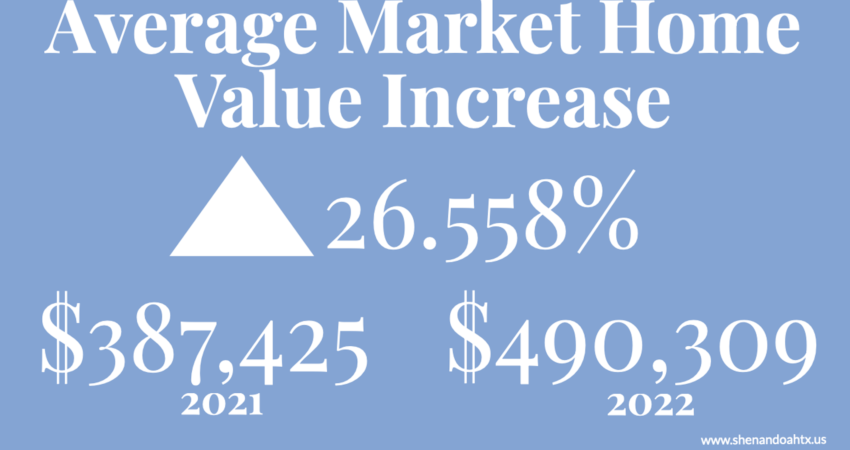

Although this translates into a lower rate compared to last year, ultimately homeowners may still owe more because of much higher appraisals this year.